Why It Matters to Us

We recognize that climate change is a preeminent sustainability issue impacting all industries today and, in particular, natural gas producers. Furthermore, the makeup of the future energy mix has significant environmental, social, and economic ramifications and will influence the future demand for, and consequently the price of, natural gas. We seek to remain informed on climate science and we are committed to understanding how climate change both affects our business and how we impact climate change.

As the nation’s largest producer of natural gas, both the impacts of climate change and the prevailing views on how to optimally curb the impacts of climate change can meaningfully impact our ability to operate. Increased frequency and severity of adverse weather events, such as storms, floods, droughts, and other extreme climatic events could cause physical damage to our assets, temporarily or permanently displace our employees and service providers, affect the availability of water necessary for our drilling and completions operations, and otherwise impact our ability to operate on schedule. In addition, the impacts of climate change also have the potential to affect us financially. Changes to federal, state, and local climate-focused laws and regulations could prohibit, inhibit, or increase the costs for us to drill for and produce natural gas. Changing consumer tastes and continued focus on climate change management and mitigation could result in decreased demand for natural gas, thereby reducing the price we receive for our product. Furthermore, our access to capital funding could be restricted if we are unable to articulate and execute our climate change strategy. Please see Risk Management for more information.

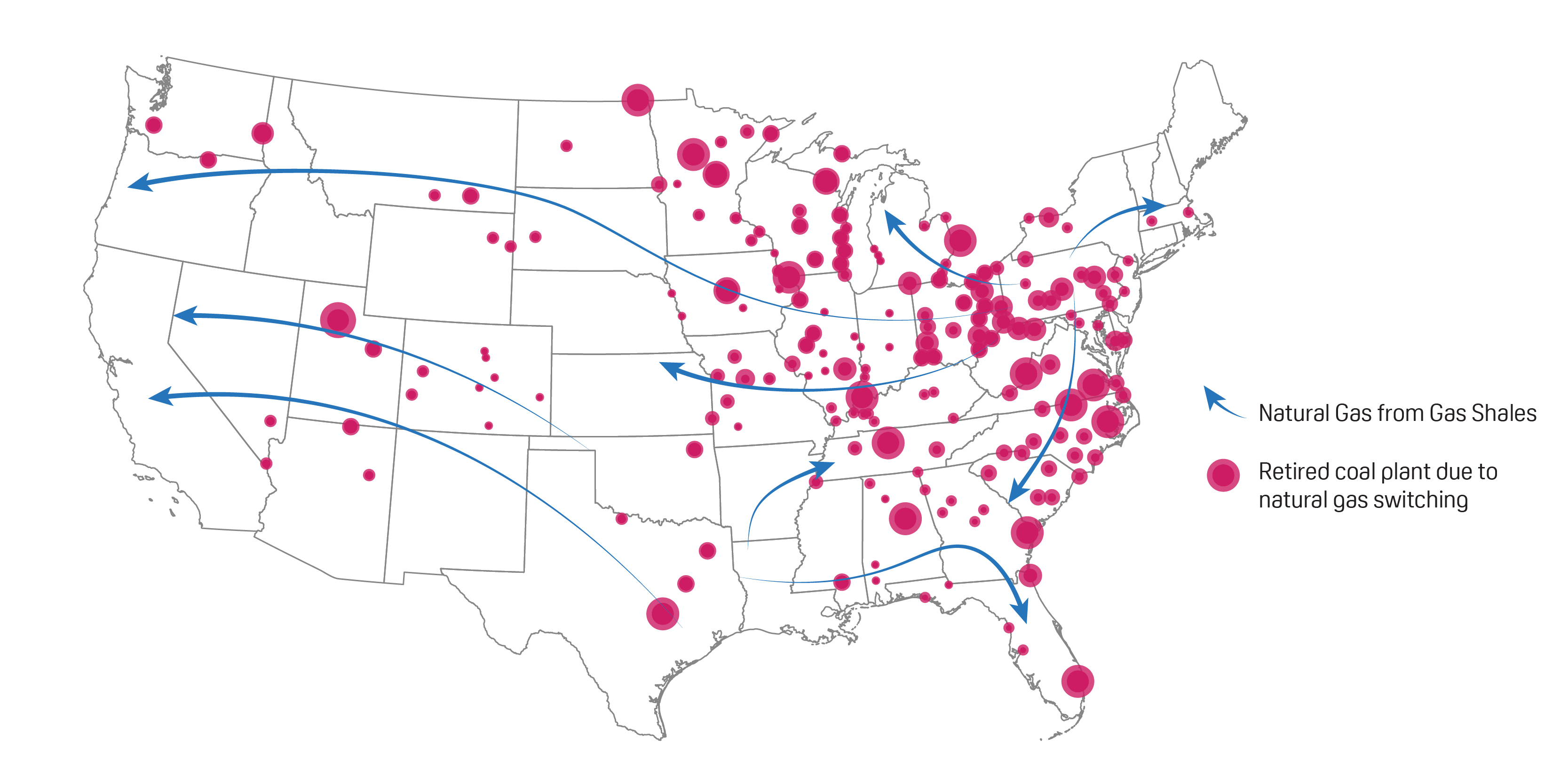

Natural gas is readily available, affordable, reliable, and clean, and represents a critical component of the domestic and global energy supply mix. In the United States, the shale revolution[1] has unlocked an abundant supply of low-cost natural gas. The benefits of the revolution have been meaningful, both in spurring the domestic economy and in maintaining reduced costs of power and heating for consumers. One of the most meaningful benefits, however, has been the impact on carbon emissions. From 2005 to 2019, the United States led all countries in the reduction of carbon emissions, decreasing its carbon emissions by approximately 1 billion metric tons (MT).[2] The leading contributor to reducing emissions in the United States was switching energy production from coal-to-gas, accounting for 61% of the emissions reduction during the approximately 15-year period.[3] In fact, over this period, the absolute emissions reductions achieved in the United States from coal-to-gas switching was roughly equivalent to the total emissions reductions from the second, third, fourth, and fifth ranked countries in terms of emissions reduction, combined.

From 2005–2020 Natural Gas Replaced > 200 Coal Plants

U.S. CO2 Emissions Reduction by Solution[4]

2005–2019 CO2 Reduction (million MT of CO2)[5]

|

Country |

CO2 Reduction |

|

United States |

-959 |

|

United Kingdom |

-188 |

| Italy | -147 |

| Germany | -144 |

| Japan | -122 |

| Ukraine | -120 |

| Spain | -104 |

| France | -77 |

| Venezuela | -51 |

| Greece | -39 |

During this same period, the United States transitioned from being a net importer to a net global exporter of natural gas.[6] The export of natural gas by the United States is critically important to addressing climate change. The United States is one of a handful of countries in the world blessed to have abundant, economically-recoverable natural gas, and as made clear in 2022, in the absence of affordable, reliable natural gas, countries will turn to coal. During 2022, many countries turned to coal to fill the gap resulting from declines in their natural gas supply in the wake of western sanctions on Russia and the sabotage of the Nord Stream pipeline. As a result, 2022 was not only an all-time high for coal emissions, but it was also an all-time high for global carbon emissions.[7]

It is our belief that, in certain countries, such as the United States, natural gas can and will be a bedrock of the future energy state. A recent study[8] by EPRI and GTI Energy modeled strategies for achieving economy-wide net-zero emissions in the United States by 2050. The study assessed three scenarios: (i) an “all options” scenario, in which low-cost natural gas and carbon capture and storage (CCUS) were available; (ii) a “higher fuel cost” scenario, in which natural gas and CCUS were available but more costly; and (iii) a “limited options” scenario in which CCUS was not available, and as a result, natural gas consumption was required to decline materially.

While all three scenarios achieved the desired goal of a net-zero economy, the “limited options” pathway resulted in an incremental annual cost per household of approximately $9,000 as compared to the “all options” scenario. To put this into context, an incremental annual cost of $9,000 per household would have the impact of putting nearly 10% of United States citizens into poverty.[9]

Looking outside our borders, it is worth highlighting that the global per capita gross domestic product (GDP) is approximately $12,000, and the per capita GDPs of China and India are approximately $12,500 and $2,200, respectively.[10] Taking as an axiom that the costs projected for achieving a net-zero economy in the United States under the three scenario types would be similar abroad, it follows that a sustainable (i.e., affordable) transition globally must rely heavily on low-cost natural gas.

Natural gas is not only abundant in the United States, the cost of production is one of the lowest in the world, while also being subject to some of the most rigorous regulatory standards for gas production globally. Exporting United States-produced natural gas enables the global expansion of benefits associated with rigorous regulatory standards for production, effectively establishing thresholds for employee safety standards, human rights, emissions and biodiversity. These benefits, along with the relatively low environmental impact of its operators, serve to justify and command a greater market share of the global energy supply mix, thereby increasing the influence of the United States on achieving its global climate goals.

Furthermore, we believe natural gas will continue to play a key role in the impact of energy on social equity locally, nationally, and internationally. Our operations are concentrated in southwestern Pennsylvania, southeastern Ohio, and northern West Virginia — areas historically characterized as lower socioeconomic regions. Responsible development of natural gas has led to an infusion of a significant amount of capital in our operating areas, both to landowners and the broader communities, and has served as an engine for improving the quality of life in these regions; please see Economic and Societal Impact for more information. Our operations can positively impact disadvantaged socioeconomic groups in the United States by providing low-cost clean energy, job opportunities, tax revenue generation, and royalty payments to landowners.

Vision for EQT in the Energy Transition

Our belief in the role of natural gas in the transition to a lower carbon future influences our corporate strategy. Our corporate strategy is divided into three segments: Evolve, Consolidate, and New Ventures. The execution of these strategic segments is not necessarily sequential; rather, each builds upon and supports the others.

Taken together, these strategies influence our long-term trajectory to support the acceleration of the transition to a lower carbon future. We believe our Evolve, Consolidate, and New Ventures strategy will allow us to react nimbly and effectively as data continues to emerge and technologies continue to develop on our collective path to a low-carbon future.

[1] The “shale revolution” refers to the combination of hydraulic fracturing and horizontal drilling that enabled the United States to significantly increase its production of natural gas, particularly from tight shale formations, beginning predominately in 2005.

[2] Source: International Energy Agency (IEA), World Energy Outlook 2021, October 2021 (https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/WorldEnergyOutlook2021.pdf); U.S. Energy Information Administration (EIA) emissions data; EIA Form 860 coal plant data; and EQT analysis.

[3] Data obtained from the EIA’s U.S. energy-related carbon dioxide emissions, 2019 report, splitting wind and solar proportionally to their increased power generation from 2005 to 2019 per the EIA’s renewable generation data.

[4] Data obtained from the EIA’s U.S. energy-related carbon dioxide emissions, 2019 report, splitting wind and solar proportionally to their increased power generation from 2005 to 2019 per the EIA’s renewable generation data.

[5] Data obtained from IEA. Source: IEA, World Energy Outlook 2021, October 2021 (https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/WorldEnergyOutlook2021.pdf); EIA emissions data; EIA Form 80 retired plant data; and EQT analysis.

[6] Source: EIA, Natural Gas Explained, chart showing U.S. natural gas imports and exports, 1950-2021 (https://www.eia.gov/energyexplained/natural-gas/imports-and-exports.php).

[7] Source: IEA, CO2 Emissions in 2022, March 2023 (https://iea.blob.core.windows.net/assets/3c8fa115-35c4-4474-b237-1b00424c8844/CO2Emissionsin2022.pdf).

[8] Source: Low-Carbon Resources Initiative, Net-Zero 2050: U.S. Economy-Wide Deep Decarbonization Scenario Analysis, December 2023 (https://lcri-netzero.epri.com/).

[9] Source: Statista, Percentage Distribution of Household Income in the United States, September 2022 (https://www.statista.com/statistics/203183/percentage-distribution-of-household-income-in-the-us/).

[10] Source: The World Bank, chart showing GDP per capita, 1960-2021 (https://data.worldbank.org/indicator/NY.GDP.PCAP.CD).

[11] “Desktop emissions” refers to emissions calculated using a prescribed emissions factor for each source of equipment utilized in our operations, as opposed to “field emissions” which are emissions measured directly in the field by new and developing technologies such as radar or satellite.

[12] In July 2019, our Board of Directors was substantially reconstituted and we welcomed a new executive team, led by our President and Chief Executive Officer, Toby Rice, to evolve EQT into a modern, digitally-enabled company, allowing us to realize our full potential. The new leadership’s goal was to build a foundation for a modern operating model capable of executing on a combo-development strategy. We have been executing this strategy since the 2019 transition.

What We Are Doing

Accelerating the Low-Carbon Transition

We recognize the risks and opportunities that climate change poses to our business and have developed a strategy for how we can best address both transition and physical risks. This strategy is underpinned by our values; represents the short-, medium-, and long-term opportunities for our organization; and is built on three foundational beliefs detailed below.

Belief 1: Natural gas is critical to accelerating a sustainable pathway to a low-carbon future and achieving global climate goals.

Natural gas is a critical commodity to facilitate the growth of renewables as part of our power supply, domestically and internationally. Among sources of continuous and reliable power, natural gas leads in its combination of accessibility, low environmental impact, and exportability. As seen with recent power shortages, natural gas has served as a necessary fuel source and fills the gap left by the intermittency of renewable power. As the United States scales renewable power while awaiting technological breakthroughs, the volatility of demand within the power sector on non-renewable power will only increase. Through 2050, the long-term outlook from the U.S. Energy Information Administration (EIA) is that petroleum and natural gas will remain the most consumed source of energy in the United States as renewables continue to be added to the grid.[1] Furthermore, rapid replacement of coal-fired power generation with natural gas-fired power generation represents the “lowest hanging fruit” in meaningfully accelerating our pathway to decarbonization — not just in the United States, but globally.

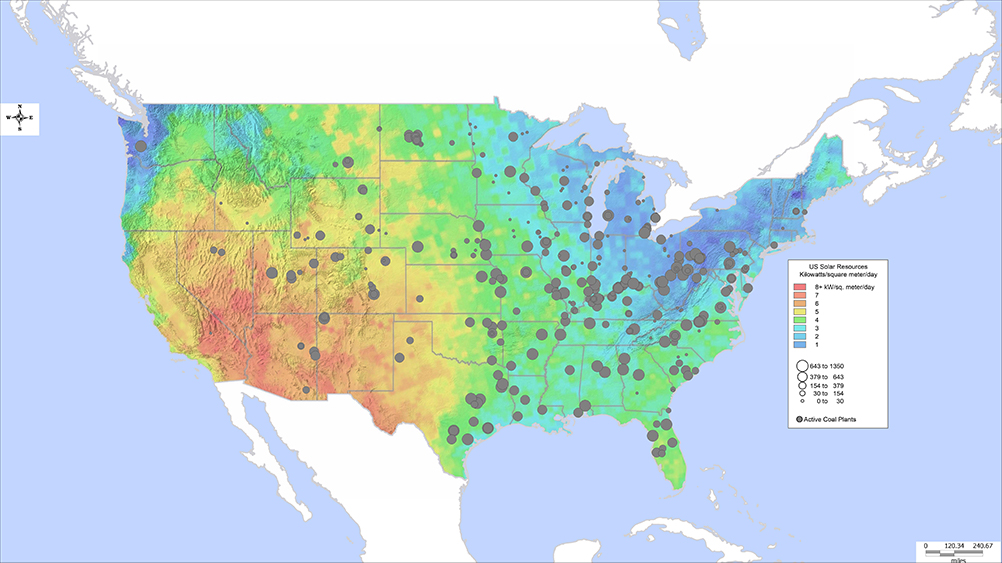

Domestically, renewable energy is rapidly increasing its impact on energy production. Solar power and batteries accounted for 60% of the planned new U.S. electric generation capacity in 2022 alone[2] according to the EIA’s preliminary monthly electric generator inventory. The benefits of increased renewable energy sources can be seen through the reduction in the electricity production share held by coal, which is the highest GHG-intensive component of the U.S. electricity generation mix. However, the ability and pace at which the United States can replace coal-fired power generation with renewables will be challenged in areas where replacement is most needed, as a significant amount of coal-fired power generation in the United States is in regions characterized as having low renewable power potential.

For instance, solar panels in the northeastern and southeastern United States are only about 15% and 50%[3] as effective, respectively, as solar panels in the southwestern United States. As such, up to eight times the materials and acreage would be needed to generate the same amount of energy from a solar panel in other parts of the United States as it would in the southwestern United States. This reduced efficiency not only impacts the economics of a solar project but also the reliability of the power generated.

U.S. Solar and Coal Resource Availability[4]

Outside of the United States, much of the world still has an energy mix roughly equivalent to that of the United States in 2005, with coal being the largest emissions source, accounting for over 42% of global energy-related carbon emissions as of the end of 2022.[5] As natural gas played the leading role in emissions reduction seen within the United States from 2005 to 2019, so too should it play the same role at the international level today.

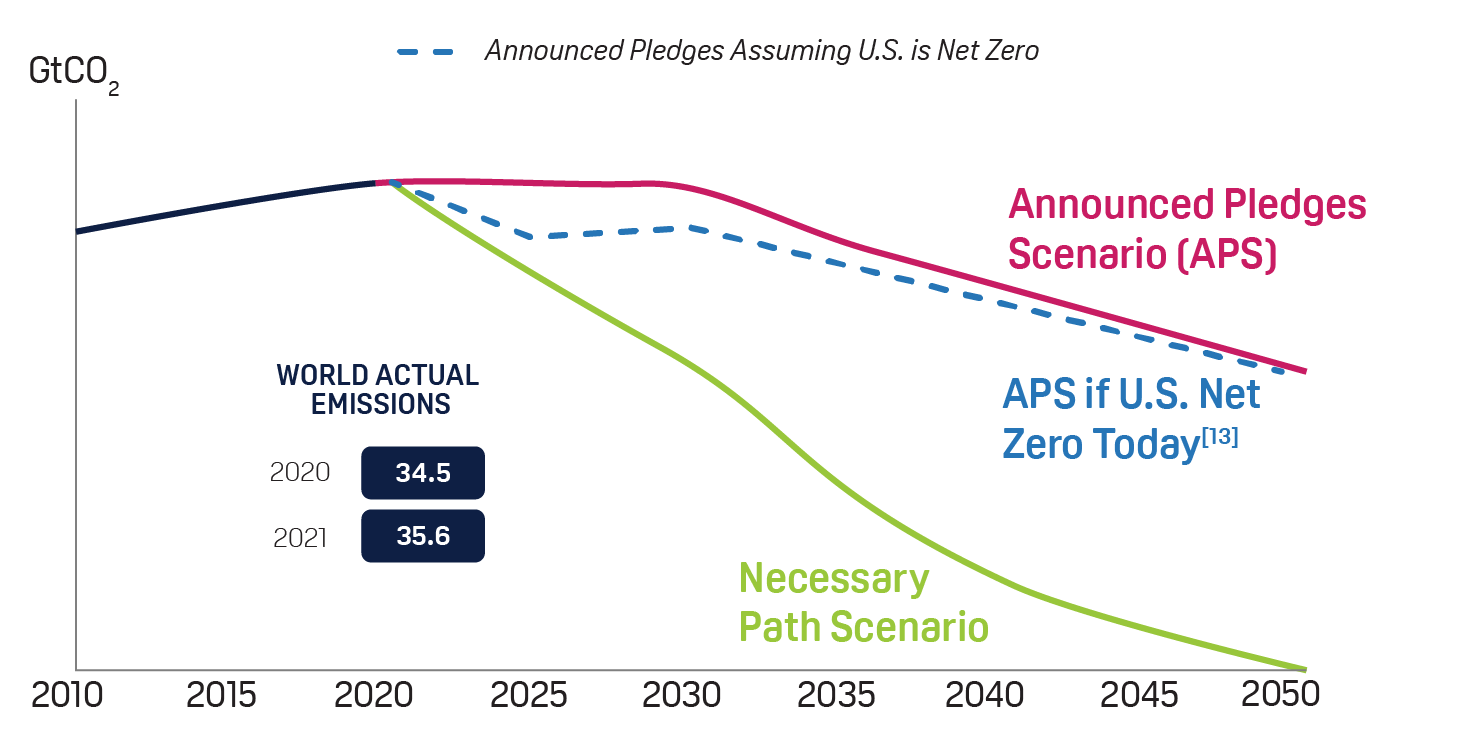

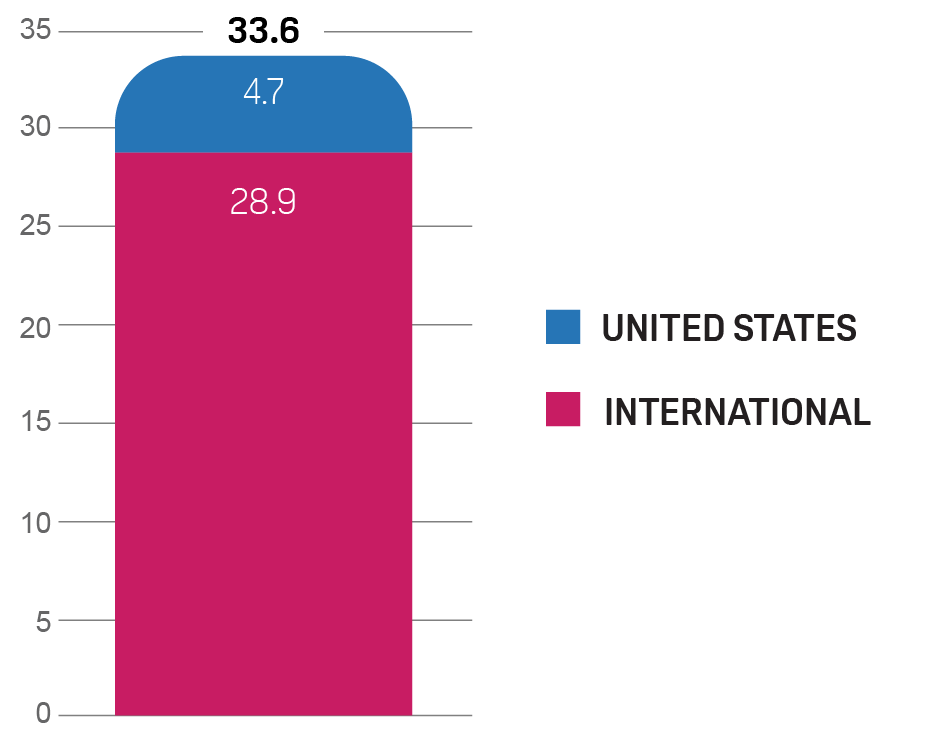

Even if the United States achieved net-zero emissions today, the world would still be on a trajectory to miss its climate goals, in large part because of the significant and growing global consumption of coal. As one of four countries[6] that make up roughly two-thirds of the world’s economically developable natural gas resources, the United States must accept its responsibility to provide natural gas to coal-reliant countries in order to assist them in achieving their necessary carbon-reduction efforts.

Global 2019 Emissions (Billion MT of CO2)

Belief 2: Natural gas (particularly Appalachian natural gas) will differentiate itself from other hydrocarbons as the optimal source for reliable, affordable, and responsibly sourced energy.

As the debate about the energy future plays out, we believe greater differentiation will occur between hydrocarbons and producers of hydrocarbons. We also believe there will be greater differentiation between natural gas-focused companies and oil-focused companies. While the production methods are similar, the consumption of oil-based products versus natural gas-based products, and the pathways to decarbonize that consumption, most effectively differ.

Emissions intensities of natural gas and oil companies are strikingly different. While we believe that all are working to reduce their intensities, natural gas companies have a significant advantage. Much like how we see natural gas differentiating itself from oil and coal, we see specific natural gas sources differentiating from others. Production of domestic natural gas, and especially natural gas produced in Appalachia — such as in the Marcellus and Utica basin — has emissions intensities lower than other domestic and foreign supply sources.[9] As a result, natural gas companies (Appalachian natural gas companies in particular) hold a meaningful advantage in the costs that will be incurred by such companies to achieve net-zero emissions.

As principal end uses differ between natural gas (power) and oil (transportation), the trajectories and cost/benefit of natural gas and oil differ as well. Moreover, the primary pathways to accelerating the low-carbon transition of one product’s end use (transportation) are through increased usage of the other’s (power for vehicle electrification and hydrogen-based transportation). As such, we believe that as the energy transition debate evolves and the focus on potential solutions shifts from supply to consumption, the traditional grouping of oil and natural gas companies will diverge.

Belief 3: U.S. natural gas has the unique potential to be the largest green initiative on the planet.

In 2005, the United States was a major consumer of coal. Over the next approximately 15 years, the United States proceeded to become a world leader in emissions reductions, predominately by utilizing gas-fired power in lieu of coal-fired power generation. Between 2005 and 2019, the United States reduced its carbon emissions by approximately 1 billion MT[10] with coal-to-gas substitution accounting for approximately 61% of U.S. emissions reductions.[11] This is a tremendous achievement but, while the United States has been able to successfully reduce its carbon emissions, other developing countries have increased their carbon emissions at a pace far surpassing U.S. reductions.

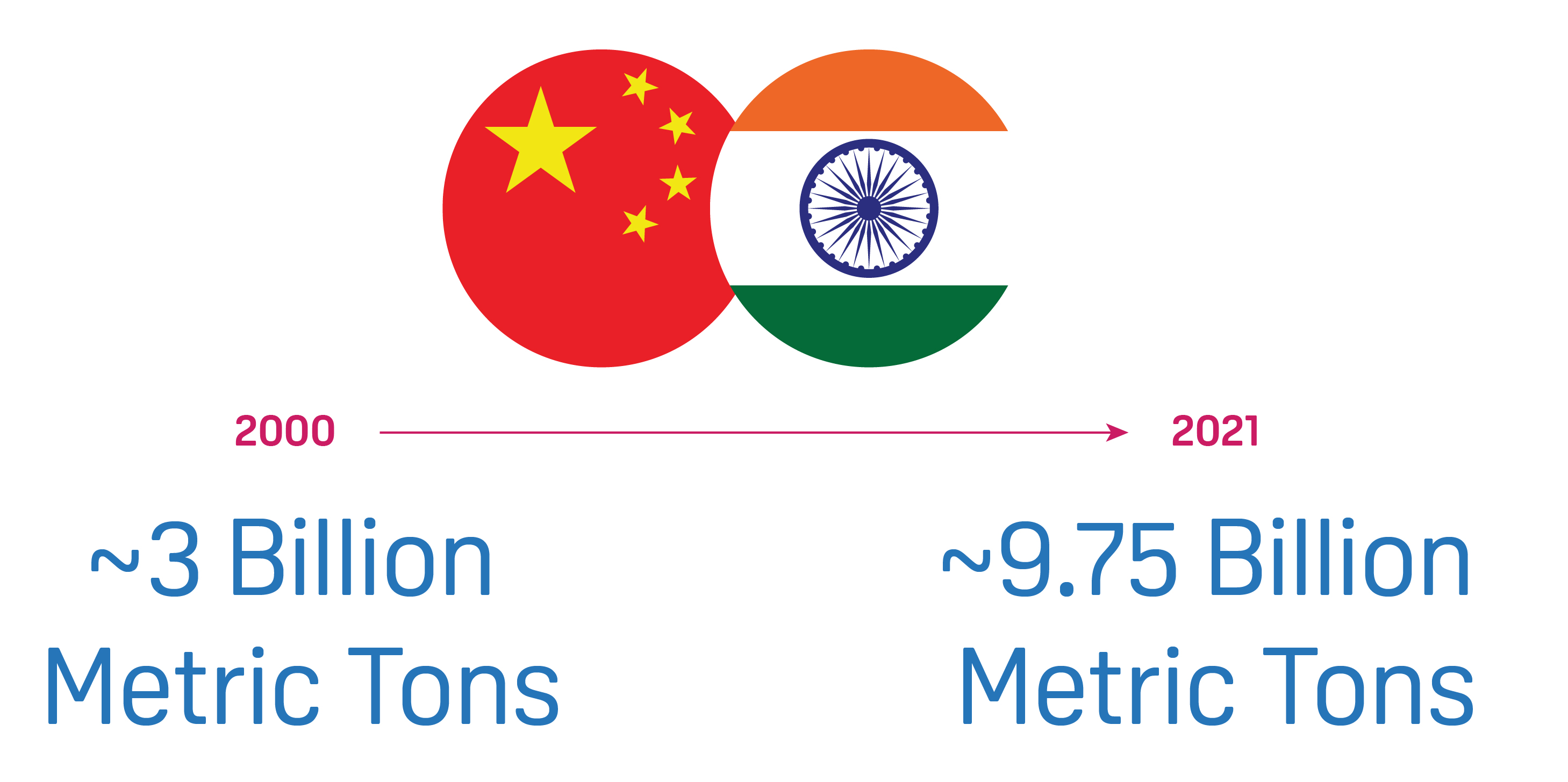

Based on preliminary data from the International Energy Agency, global coal use is expected to have increased by 1.2% in 2022 compared to 2021, surpassing 8 billion tonnes in a single year for the first time and eclipsing the previous record set in 2013.[12] Two countries, China and India, account for the significant majority of global coal consumption, with China alone accounting for 53% of global coal consumption in 2022.[13] Approximately 124 gigawatts (GW) of coal power plants were under construction in China and India as of the end of 2021 (comprising over 70% of global coal plants under construction), with another 182 GW in pre-construction.[14] These newly constructed coal plants would equate to over three times the coal capacity retired by the United States from 2013 through 2020.[15]

China and India Combined Coal Emissions[16]

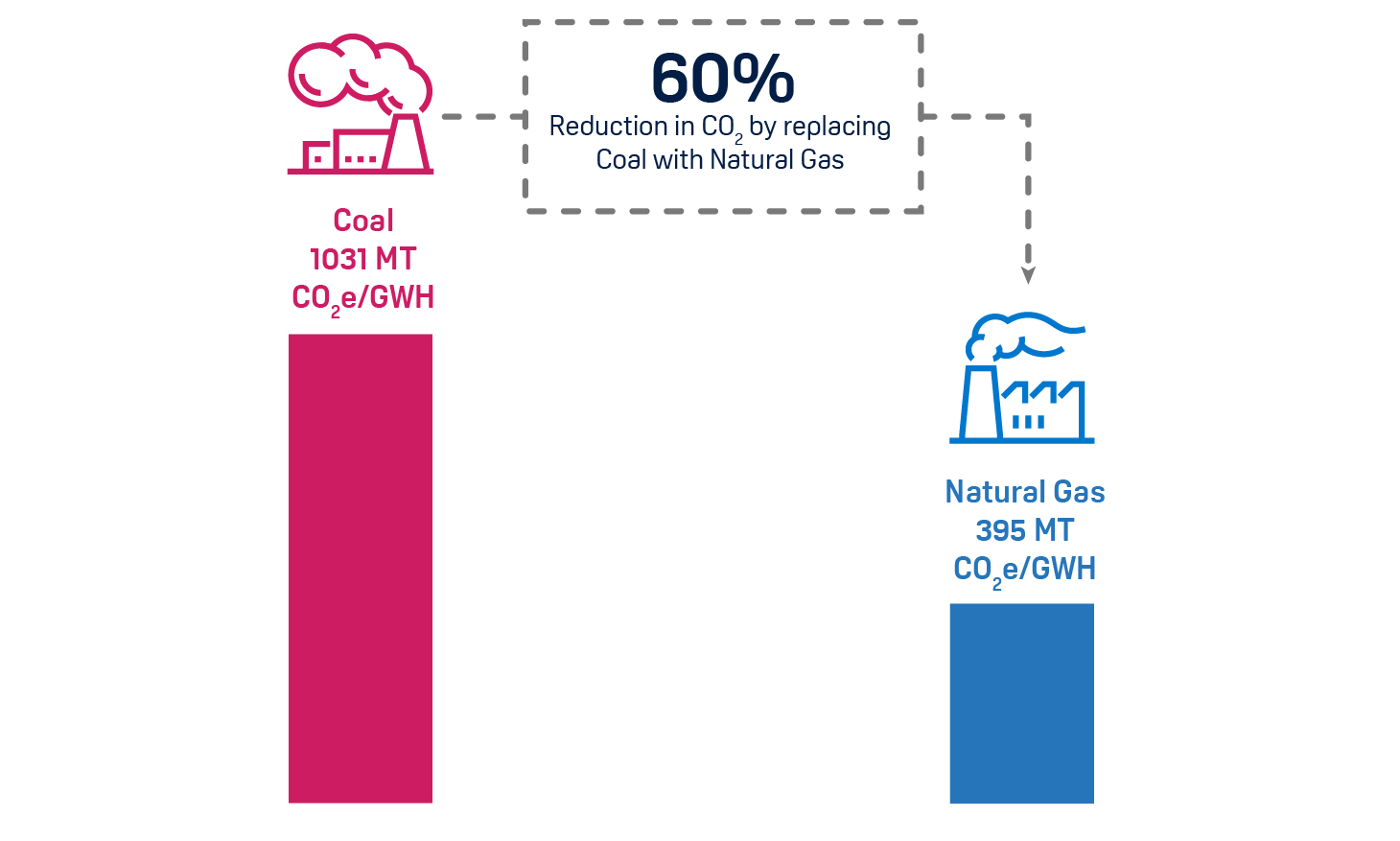

Natural gas power generation has unique attributes which make it an optimal alternative to coal power generation. including the following:

- Natural gas power plants provide baseload energy, which complements intermittent energy sources like wind and solar;

- Natural gas plants run more efficiently than coal plants (approximately one natural gas plant can replace approximately two coal plants);[17]

- Natural gas emits 60% less carbon than a comparable amount of coal;[18]

- Natural gas has a lower emissions intensity compared to oil and coal; and

- Natural gas is relatively affordable compared to other fossil fuels and significantly more affordable than renewable sources.

We believe there is approximately 175 billion cubic feet (Bcf) per day[19] of coal-to-gas switching demand in the world. If we were to quadruple U.S. liquefied natural gas (LNG) capacity to 55 Bcf per day[20] by 2030, we believe we could reduce international carbon emissions by an incremental 1.1 billion MT per year — a 60% reduction in global carbon emissions. The emissions reduction impact of an unleashed U.S. LNG scenario would have a combined effect equal to the following:

We believe there is approximately 175 billion cubic feet (Bcf) per day[19] of coal-to-gas switching demand in the world. If we were to quadruple U.S. liquefied natural gas (LNG) capacity to 55 Bcf per day[20] by 2030, we believe we could reduce international carbon emissions by an incremental 1.1 billion MT per year — a 60% reduction in global carbon emissions. The emissions reduction impact of an unleashed U.S. LNG scenario would have a combined effect equal to the following:

- Electrifying every U.S. passenger vehicle;

- Powering every home in America with rooftop solar and backup battery packs; and

- Adding 54,000-industrial scale windmills, doubling U.S. wind capacity.

Additionally, as U.S. LNG is unleashed from the basin, U.S. citizens that own land resources with natural gas production capacity would be paid for this initiative in the form of tax revenues and $75 billion in additional annual royalties.[21]

While it is common to think of emissions on a country basis, similar to gross domestic product (GDP) and other measures, emissions ultimately have no borders and climate change is inherently a global issue. We believe that replacing international coal with U.S. natural gas should be our primary focus in reducing global emissions.

[1] Source: EIA, Annual Energy Outlook 2022, March 2022 (https://www.eia.gov/pressroom/releases/press496.php).

[2] Source: EIA, March 7, 2022 release (https://www.eia.gov/todayinenergy/detail.php?id=51518).

[3] Based on kilowatts per square meter per day. Source: Hitachi ABB Power Grids. Data as of March 20, 2023.

[4] Source: Hitachi ABB Power Grids. Data as of March 20, 2023.

[5] Source: IEA, CO2 Emissions in 2022, March 2023 (https://iea.blob.core.windows.net/assets/3c8fa115-35c4-4474-b237-1b00424c8844/CO2Emissionsin2022.pdf), showing 2022 total global energy-related CO2 emissions as 36.8 Gt, and 2022 global energy-related CO2 emissions from coal as 15.5 Gt.

[6] Approximately two-thirds of the world’s economically developable natural gas is concentrated in the Unities States, Russia, Iran, and Qatar. Source: Reserves per country from Organization of the Petroleum Exporting Countries Annual Statistical Bulletin 2021; U.S. resources obtained from the EIA.

[7] “Announced Pledges Scenario” (APS) assumes that all climate commitments made by governments around the world and longer-term net-zero targets, will be met in full and on time. “Necessary Path Scenario” sets out a narrow pathway for the global energy sector to achieve net-zero CO2 emissions by 2050.

[8] Assuming U.S. 2020 4.8 GtCO2 emissions become zero by 2025.

[9] Source: Clean Air Task Force, Benchmarking Methane and Other GHG Emissions of Oil & Natural Gas Production in the United States, June 2021 (https://www.catf.us/resource/benchmarking-methane-emissions/).

[10] Source: IEA, World Energy Outlook 2021, October 2021 (https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/WorldEnergyOutlook2021.pdf); EIA emissions data; EIA Form 860 coal plant data; and EQT analysis.

[11] Data obtained from the EIA’s U.S. energy-related carbon dioxide emissions, 2019 report, splitting wind and solar proportionally to their increased power generation from 2005 to 2019 per the EIA’s renewable generation data.

[12] Source: IEA, Fuel Report: Coal 2022, December 2022 (https://www.iea.org/news/the-world-s-coal-consumption-is-set-to-reach-a-new-high-in-2022-as-the-energy-crisis-shakes-markets).

[13] India Source: Statista, China Source: Statista.

[14] Source: Global Energy Monitor, 2022 Boom and Bust Coal, April 2022 (https://globalenergymonitor.org/wp-content/uploads/2022/04/BoomAndBustCoalPlants_2022_English.pdf).

[15] Between 2013 and 2020, the United States retired 101.3 GW of coal capacity. Source: Global Energy Monitor, 2021 Boom and Bust Report, April 2021 (https://globalenergymonitor.org/report/boom-and-bust-2021-tracking-the-global-coal-plant-pipeline-2/).

[16] India Source: Statista, China Source: Statista.

[17] Source: EIA, Carbon Dioxide Emissions Coefficients (https://www.eia.gov/environment/emissions/co2_vol_mass.php); EIA, Table 8.1 Average Operating Heat Rate for Selected Energy Sources, 2011-2021 (https://www.eia.gov/electricity/annual/html/epa_08_01.html).

[18] Source: EIA, Carbon Dioxide Emissions Coefficients (https://www.eia.gov/environment/emissions/co2_vol_mass.php); EIA, Table 8.1 Average Operating Heat Rate for Selected Energy Sources, 2011-2021 (https://www.eia.gov/electricity/annual/html/epa_08_01.html).

[19] Source: IEA, World Energy Outlook 2021, October 2021 (https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/WorldEnergyOutlook2021.pdf); and EQT analysis.

[20] Including current capacity, capacity under construction, and future new capacity.

[21] Incremental cumulative royalties above 2021 levels from 2022 to 2030 assuming 20% of revenue at $3.75 per million cubic feet.

Governance

We maintain a management-led ESG Committee, comprised of our Chief Executive Officer, General Counsel, Chief Financial Officer, and other senior leaders, which bears the primary responsibility for identifying and managing applicable climate-related risks and opportunities. Our ESG Committee also assists our executive team and senior management in developing, implementing, and monitoring initiatives, processes, policies, and disclosures pertaining to climate risks and opportunities.

Two Board-level committees also play an integral role in assessing our ability to appropriately manage climate risks and opportunities. The Corporate Governance Committee and the Public Policy and Corporate Responsibility (PPCR) Committee of our Board of Directors routinely evaluate and provide oversight, guidance, and perspective on our climate risks and initiatives including our emissions reduction targets. Our General Counsel and our Vice President of Environmental, Health, and Safety provide quarterly updates on our climate initiatives to the PPCR Committee and annual updates to our Corporate Governance Committee. In response to such updates, the PPCR Committee and the Corporate Governance Committee provide comments and feedback on our climate risk management, and emissions reduction initiatives and targets, which are relayed to our ESG Committee.

Our Environmental, Production, Finance, and Business Information Technology teams work collaboratively to explore and implement innovative technologies to collect, report, forecast, and reduce our emissions and manage our other climate risks in line with initiatives established by our ESG Committee. Oversight of these initiatives is managed through our digital work environment and monitored by our ESG Committee. For additional information on our Board committees, compensation programs, and ESG oversight, see Corporate Governance.

Risk Management

Our Enterprise Risk Committee, comprised of our Chief Financial Officer, General Counsel, Chief of Staff and other members of management, oversees identifying and managing corporate-level risks using the COSO Enterprise Risk Management Framework. To align our focus on our primary business risks, our Enterprise Risk Committee surveys senior leaders annually to assess our most significant, or “Tier 1,” enterprise risks. Based on this survey, our Enterprise Risk Committee creates a list of our top risks and presents this information to our Board of Directors on an annual basis. Our Enterprise Risk Committee also conducts quarterly follow-up assessments to re-rank top risks and identify new or more effective measures for mitigation.

Our Enterprise Risk Committee has delegated to our ESG Committee primary responsibility for identifying and managing climate-related risks. As we continue to evolve our risk function, we plan to more explicitly incorporate the transition and physical risks associated with climate change into our risk analysis.

Our Production, Completions, and Finance teams utilize models and forecasts to assess the impact of our identified risks. Assessing the impact of our identified risks includes financial modeling and commodity forecasting. For climate change specifically, we consider risks to our business including accessibility of water for our operations, different carbon-pricing scenarios, and demand for natural gas, renewables, and other energy sources. We use a proprietary emissions model that is integrated into our financial model, to better understand carbon pricing and enable us to make business decisions based on both financial and climate impact. We use this model to project what our anticipated GHG and methane emissions will be up to seven years into the future and to determine the projected amount and cost to purchase carbon credits or generate carbon offsets necessary for us to achieve our net-zero target. We use various carbon-pricing projections based on the Regional GHG Initiative and the California Carbon Credit Exchange to model different carbon-pricing scenarios and the corresponding impacts on our operations and financial profile.

ESG REPORT

ESG REPORT